Markets rallied again yesterday with the S&P 500 closing up 1.48%. It seems they rally was driven by hopes of <random positive news> and more stimulus. But really, we're at a loss. This is the most disconnected we've ever seen economic data and stock markets. It happens for brief periods of time, sort of, but not for this long and this wide of a divergence.

A lot of the charts and data we share makes sense. We literally shut down the economy on purpose, so of course there will be carnage in data. But the damage we've done isn't easily repairable. And a lot of it just needed a catalyst to burst. And either way, the data doesn't translate into all-time highs for the stock market. That's our problem. Stocks shouldn't be this high. It's nuts.

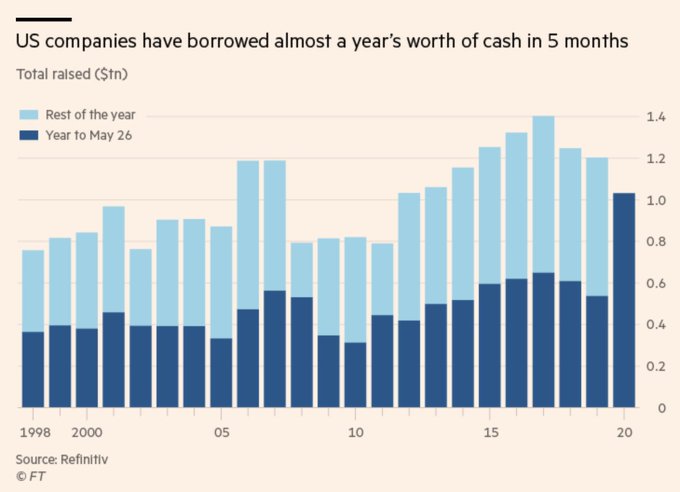

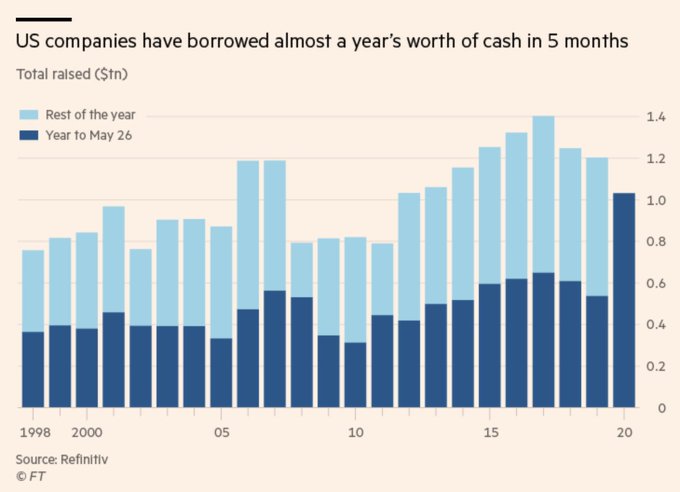

1) Bubbles - last time was households. This time is corporations. Bubbles pop. We need to de-lever! And yet, corporations have added nearly a year's worth of debt in just 5 months!

2) We found another chart for the bulls. Market cap to Money Supply. Obviously, money supply is at all time highs. We've shared various money supply charts. It's sort of an inflation-adjusted way to think about stock prices. But without inflation, should stocks be higher by this metric? It's an interesting thought.

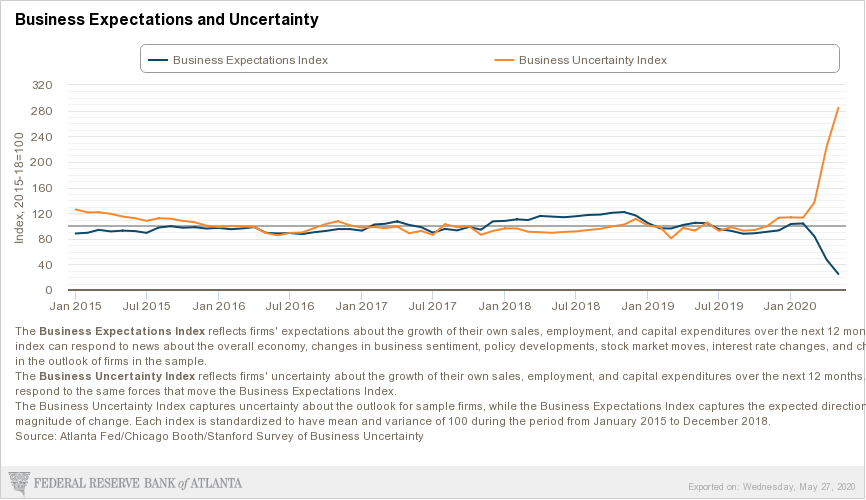

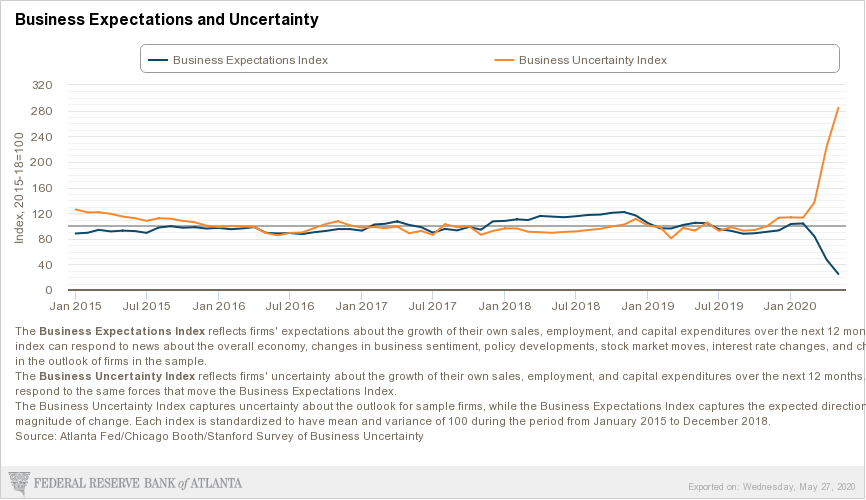

3) Look at the gap between Business Expectations and Business Uncertainty. It's never been wider!

We didn't do much yesterday. We bought our weekly planned shares of AWK. It might not be the best price all week, but it was below last week's price. We also got stopped out of our AVGO position in the morning when the various indexes were negative. We need to find more long exposure over the next few days - or take off some shorts before the weekend.

The open yesterday was a classic beginning of a correction kind of move. We opened strong and fell pretty hard, pretty fast. The reversal to finish at the highs of the day would be worrisome if not for another day of really low volume. We'll see how today goes before throwing in the towel and treading more lightly for a spell.

Again, today's plan is to find a few longs and/or cover some shorts to modestly reduce our net short exposure.

A lot of the charts and data we share makes sense. We literally shut down the economy on purpose, so of course there will be carnage in data. But the damage we've done isn't easily repairable. And a lot of it just needed a catalyst to burst. And either way, the data doesn't translate into all-time highs for the stock market. That's our problem. Stocks shouldn't be this high. It's nuts.

1) Bubbles - last time was households. This time is corporations. Bubbles pop. We need to de-lever! And yet, corporations have added nearly a year's worth of debt in just 5 months!

2) We found another chart for the bulls. Market cap to Money Supply. Obviously, money supply is at all time highs. We've shared various money supply charts. It's sort of an inflation-adjusted way to think about stock prices. But without inflation, should stocks be higher by this metric? It's an interesting thought.

3) Look at the gap between Business Expectations and Business Uncertainty. It's never been wider!

We didn't do much yesterday. We bought our weekly planned shares of AWK. It might not be the best price all week, but it was below last week's price. We also got stopped out of our AVGO position in the morning when the various indexes were negative. We need to find more long exposure over the next few days - or take off some shorts before the weekend.

The open yesterday was a classic beginning of a correction kind of move. We opened strong and fell pretty hard, pretty fast. The reversal to finish at the highs of the day would be worrisome if not for another day of really low volume. We'll see how today goes before throwing in the towel and treading more lightly for a spell.

Again, today's plan is to find a few longs and/or cover some shorts to modestly reduce our net short exposure.

Comments

Post a Comment