China has made two huge global security moves of aggression we need to talk about:

- Hong Kong: Basically ending their quasi-independence.

- India: Skirmish/dispute at the border.

Each one of these would be major news in normal times. Together, it's totally something we need to watch. This is major news. And very troublesome. Throw in Trump's trade war with them and it's got the makings of some serious global instability.

Trump plans to hold a press conference today to discuss China - so we'll see what the US thinks. We fear he'll be too focused on punishment and not enough on diplomacy. China is making some aggressive geo-political moves right now - and tariffs will only embolden them, in our opinion.

The market seemed steady all day yesterday until there were 45 minutes left in the trading day. That's when news broke of the aforementioned Trump presser on China - and the market started to dump. The S&P 500 finished down 0.21% after being up over 1% at the highs of the day.

1) Bankruptcies. May 2020 saw the most large U.S. bankruptcy filings since 2009. And it seems these filings are just getting started. We expect many more, perhaps record numbers, as the year progresses.

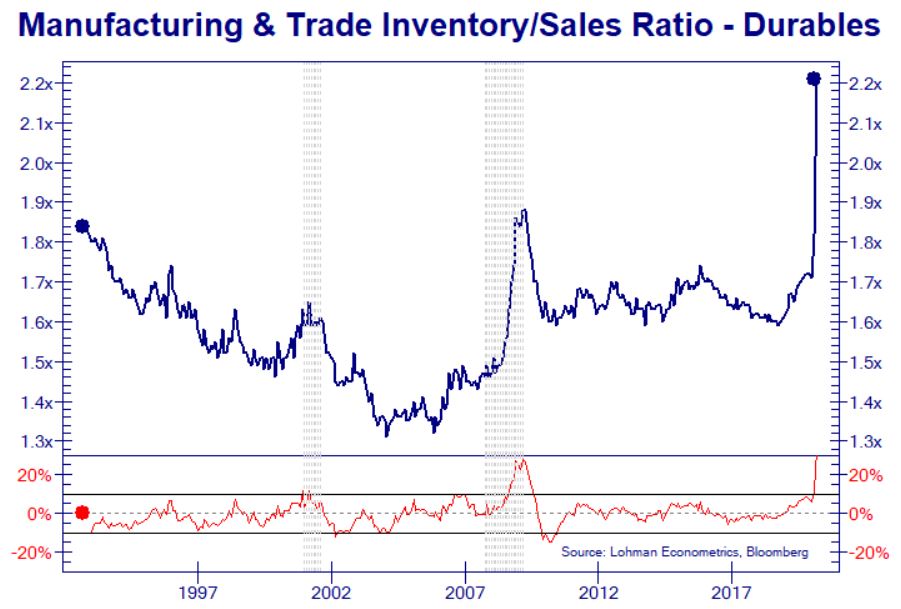

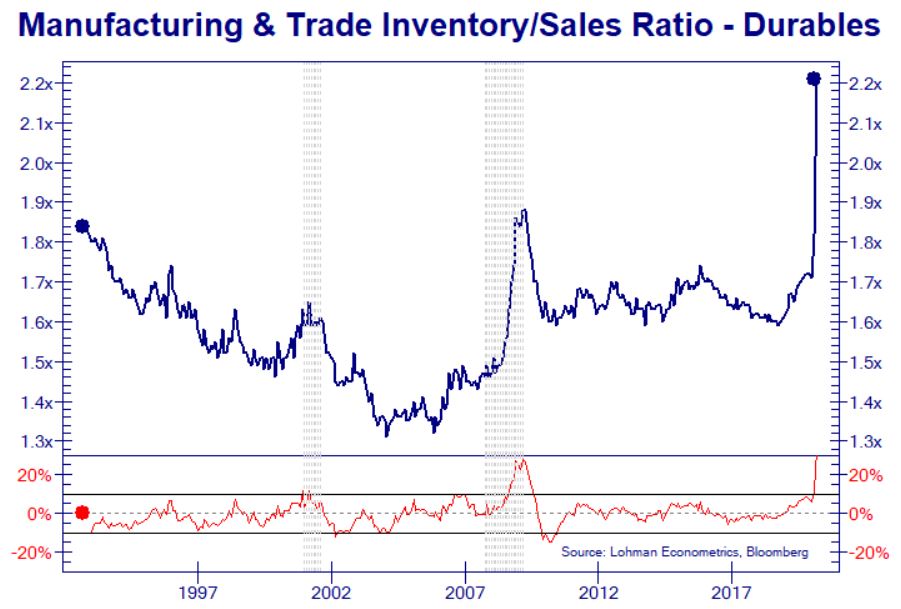

2) Another shocking chart: Inventory to Sales Ratio. All-time highs. The Fed can't buy inventories...yet.

3) Europe's central bank has been successful with crushing bond spreads across the region. This is the chart of Italian to German bonds. Italy is like Illinois - it has a lot of debt and is considered a credit risk. Germany is the USA - minimal credit risk. Germany is really helping support the European Union in this crisis - will they get something in return?

Yesterday, we bought a new position in STX, added to TLT, and covered our PHM position.

There is a lot of wood to chop today - we're sitting at 20% net short and will go into the weekend closer to 10% short. So we need to cover some shorts and/or add some longs - depending on how markets perform today.

Adding more GDX is a likely way to reduce our short exposure. We don't want to give up on the ITB short, but perhaps we'll throw in the towel on that like we did PHM and LEN. Those two trades would get us to 10% short, but before transacting, we'll see what the markets do.

Stay nimble, stay active, and stay safe!

Trump plans to hold a press conference today to discuss China - so we'll see what the US thinks. We fear he'll be too focused on punishment and not enough on diplomacy. China is making some aggressive geo-political moves right now - and tariffs will only embolden them, in our opinion.

The market seemed steady all day yesterday until there were 45 minutes left in the trading day. That's when news broke of the aforementioned Trump presser on China - and the market started to dump. The S&P 500 finished down 0.21% after being up over 1% at the highs of the day.

1) Bankruptcies. May 2020 saw the most large U.S. bankruptcy filings since 2009. And it seems these filings are just getting started. We expect many more, perhaps record numbers, as the year progresses.

2) Another shocking chart: Inventory to Sales Ratio. All-time highs. The Fed can't buy inventories...yet.

3) Europe's central bank has been successful with crushing bond spreads across the region. This is the chart of Italian to German bonds. Italy is like Illinois - it has a lot of debt and is considered a credit risk. Germany is the USA - minimal credit risk. Germany is really helping support the European Union in this crisis - will they get something in return?

Yesterday, we bought a new position in STX, added to TLT, and covered our PHM position.

There is a lot of wood to chop today - we're sitting at 20% net short and will go into the weekend closer to 10% short. So we need to cover some shorts and/or add some longs - depending on how markets perform today.

Adding more GDX is a likely way to reduce our short exposure. We don't want to give up on the ITB short, but perhaps we'll throw in the towel on that like we did PHM and LEN. Those two trades would get us to 10% short, but before transacting, we'll see what the markets do.

Stay nimble, stay active, and stay safe!

Comments

Post a Comment