Jobless claims yesterday came in right in-line with consensus expectations. However, there was a huge spike in Pandemic Unemployment Assistance (PUA) claims to 2.2 million. PUA claims are basically "gig economy" workers who couldn't file claims under the classic system but can under the enhanced/expanded system of the CARES Act.

Despite the continuing weakness in the employment picture, the stock market finished down just 0.78% on the S&P 500 with the Russell 2000 up just slightly. But volume was weak and we finished into weakness, not strength.

1) PUA claim history. Each bar is a week. News must have gotten out about filing for PUA.

2) An interesting way to look at the stock market. If you assume it is mean-reverting and provides the average return, it's well above trend.

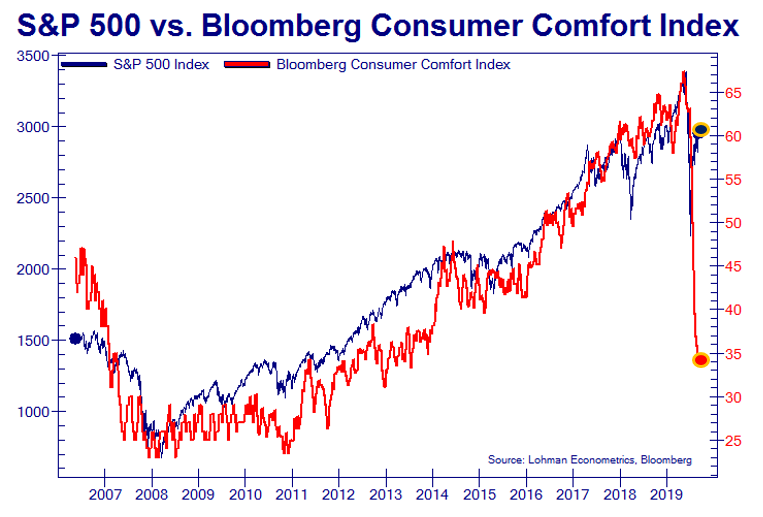

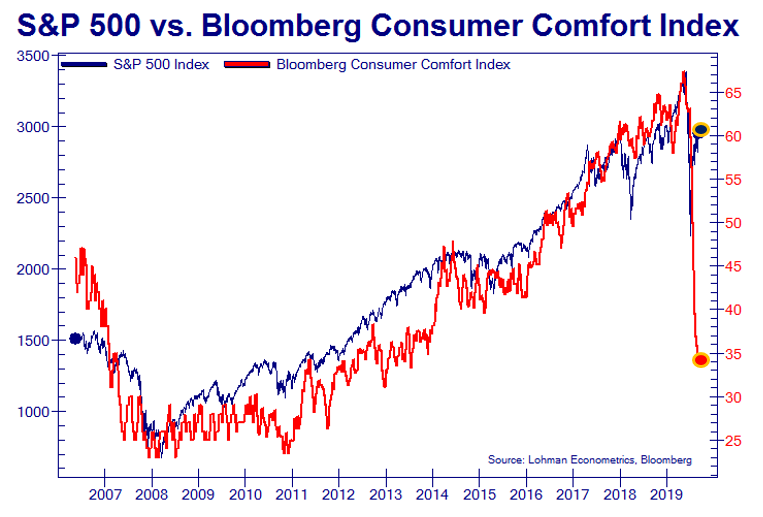

3) We can't resist posting these various charts. The ones that show data series that have strong historical relationships compared to the stock market.This particular one is the Bloomberg Consumer Comfort Index vs. the S&P 500. Clearly, the two series were highly correlated until recently. And then something broke. OR the stock market needs to correct hard to come back in-line with all of the various data points and series. We're clearly in the latter camp.

We're still very bearishly positioned at -19% short of equities after adding back our position in BUD for $1.16/share less than where we sold it. We added some more gold exposure - this time directly in GLD rather than GDX. GLD gives us direct exposure to the commodity price without the equity market risk associated with GDX, the gold miners. Buy gold miners when you want equity risk AND gold price risk. Buy GLD when you want just gold price risk.

Going into a long weekend, we may not stay so net short. If we have to, we'll buy an ETF to hedge out our risk somewhat at the end of the day.

The markets are closed on Monday for Memorial Day.

_________________________________________________________________________

Unrelated to the markets, our dear dog Fry died yesterday afternoon. He was a great dog and will be dearly missed. We're taking his loss pretty hard. Rest in peace, Fry.

Despite the continuing weakness in the employment picture, the stock market finished down just 0.78% on the S&P 500 with the Russell 2000 up just slightly. But volume was weak and we finished into weakness, not strength.

1) PUA claim history. Each bar is a week. News must have gotten out about filing for PUA.

2) An interesting way to look at the stock market. If you assume it is mean-reverting and provides the average return, it's well above trend.

3) We can't resist posting these various charts. The ones that show data series that have strong historical relationships compared to the stock market.This particular one is the Bloomberg Consumer Comfort Index vs. the S&P 500. Clearly, the two series were highly correlated until recently. And then something broke. OR the stock market needs to correct hard to come back in-line with all of the various data points and series. We're clearly in the latter camp.

We're still very bearishly positioned at -19% short of equities after adding back our position in BUD for $1.16/share less than where we sold it. We added some more gold exposure - this time directly in GLD rather than GDX. GLD gives us direct exposure to the commodity price without the equity market risk associated with GDX, the gold miners. Buy gold miners when you want equity risk AND gold price risk. Buy GLD when you want just gold price risk.

Going into a long weekend, we may not stay so net short. If we have to, we'll buy an ETF to hedge out our risk somewhat at the end of the day.

The markets are closed on Monday for Memorial Day.

_________________________________________________________________________

Unrelated to the markets, our dear dog Fry died yesterday afternoon. He was a great dog and will be dearly missed. We're taking his loss pretty hard. Rest in peace, Fry.

Comments

Post a Comment