The Novavax vaccine rally caused futures to rise, but stocks traded flat from the open all day before fading and closing at the lows (and below the open) - but finishing up 1.23% on the S&P 500. It wasn't a "healthy" rally day with the rally's leader, Tech (XLK), closing lower. Futures are up big again this morning.

There isn't much out in the markets to get us excited or bulled up. Data is horrible. Underlying economic conditions are bad. People are behaving like idiots - and could lead to a spike in confirmed coronavirus cases (and deaths). We're doing our best to stay neutral, but this market is begging for shorts. Something might be afoot - Fed buying stocks/futures or something.

1) Another example of our bread & butter charts: Chicago Fed National Activity Index. Off a cliff. Nearly every data series looks either off of a cliff or straight up.

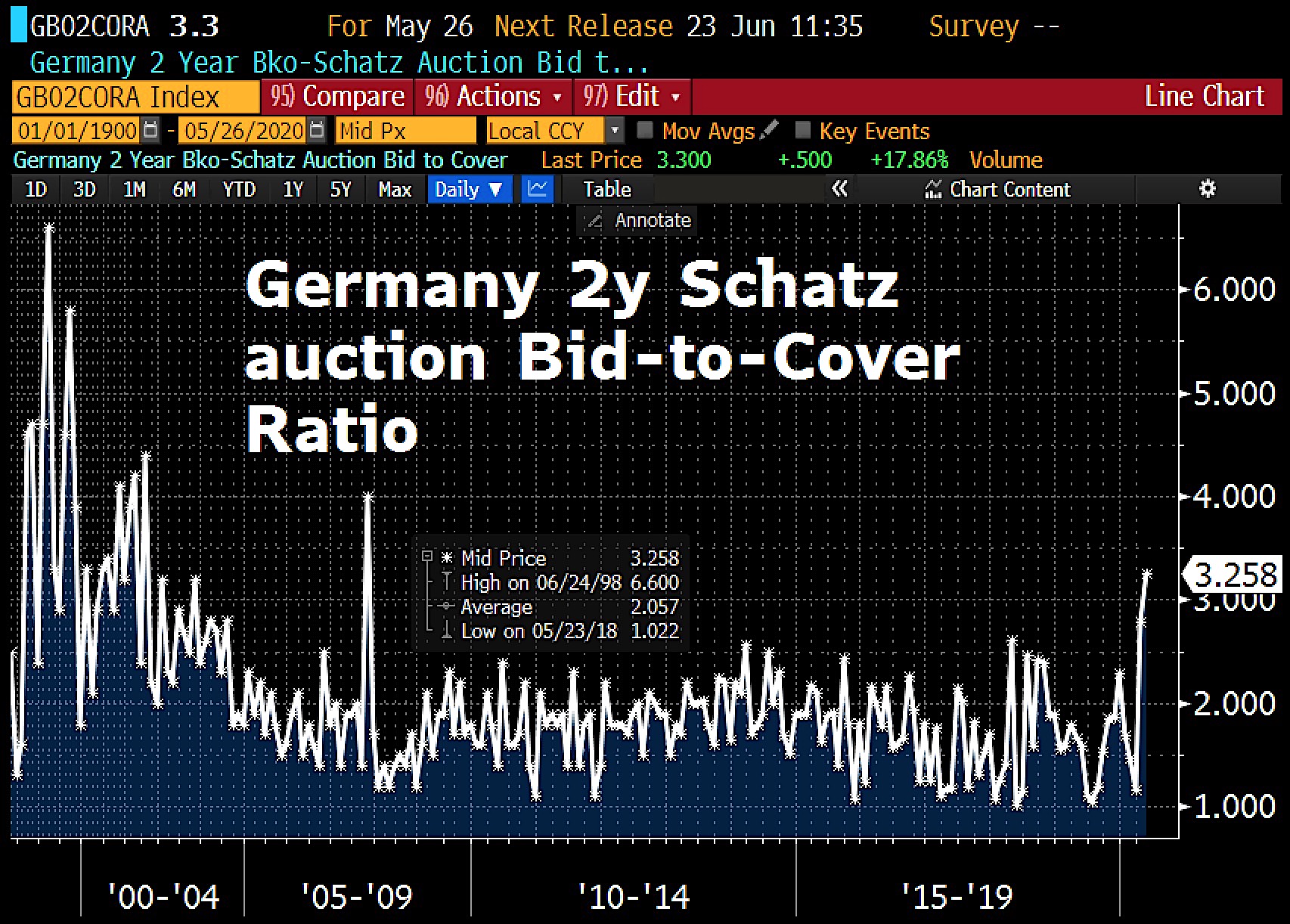

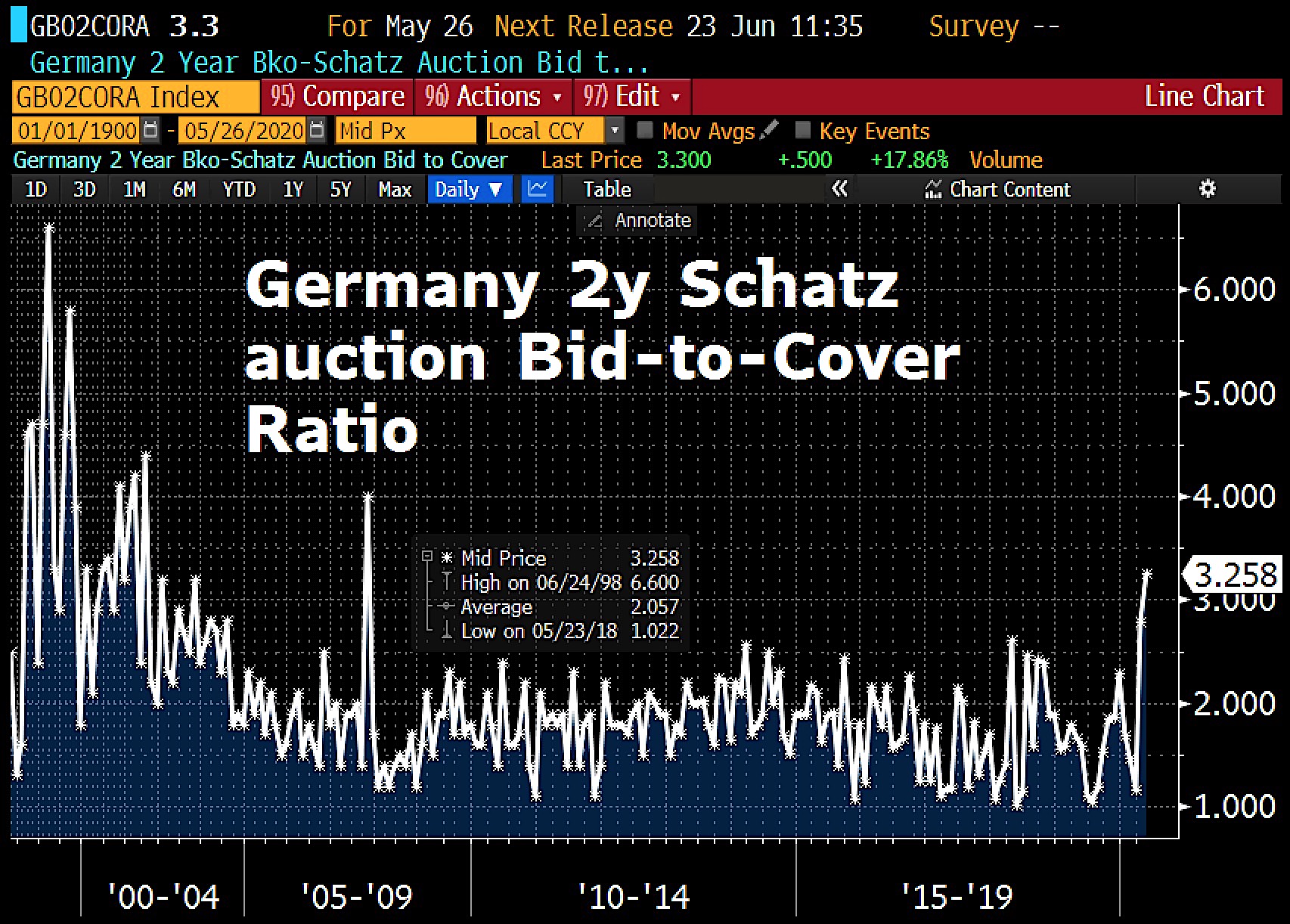

2) Germany issued 2-year bonds yesterday at a negative -0.66% yield. It was bid-to-covered (oversubscribed) by 3.3x! The highest since the GFC. Yeah, that's normal.

3) Now a chart that matches the stock market! Global Liquidity vs. the S&P 500. Does liquidity make businesses better? Does it grow earnings? Or does it just keep the music playing while more and more chairs get removed? What happens when players collapse before the music stops?

Clearly, the rally continues to make zero sense to us. So we're shorting it pretty hard. Yesterday, we aggressively shorted 5% more IWM and put on a naked bank short, with a 5% KBE trade. We sold our BUD shares for a hefty profit and like where we're sitting at 23% net short.

Today, we'll keep hunting for ways to enhance our position - perhaps buying gold or Treasuries. Perhaps adding more shorts.

There isn't much out in the markets to get us excited or bulled up. Data is horrible. Underlying economic conditions are bad. People are behaving like idiots - and could lead to a spike in confirmed coronavirus cases (and deaths). We're doing our best to stay neutral, but this market is begging for shorts. Something might be afoot - Fed buying stocks/futures or something.

1) Another example of our bread & butter charts: Chicago Fed National Activity Index. Off a cliff. Nearly every data series looks either off of a cliff or straight up.

2) Germany issued 2-year bonds yesterday at a negative -0.66% yield. It was bid-to-covered (oversubscribed) by 3.3x! The highest since the GFC. Yeah, that's normal.

3) Now a chart that matches the stock market! Global Liquidity vs. the S&P 500. Does liquidity make businesses better? Does it grow earnings? Or does it just keep the music playing while more and more chairs get removed? What happens when players collapse before the music stops?

Clearly, the rally continues to make zero sense to us. So we're shorting it pretty hard. Yesterday, we aggressively shorted 5% more IWM and put on a naked bank short, with a 5% KBE trade. We sold our BUD shares for a hefty profit and like where we're sitting at 23% net short.

Today, we'll keep hunting for ways to enhance our position - perhaps buying gold or Treasuries. Perhaps adding more shorts.

Comments

Post a Comment