It's Thursday, so that means another round of Initial Jobless Claims. A green close last Thursday keeps the streak of Jobless Claims over 2 million leading to an up day in the stock market pretty intact. In fact, only ONE TIME have Jobless Claims exceeded 2 million and stocks closed lower. In history. So we'll see what happens if we get another historically high number an hour before the open.

Stocks finished up 1.67% yesterday, as measured by the S&P 500. We took the up day as an opportunity to cut our net and gross exposure by 9%. We're sitting at 21% net short of equities and 57% gross exposed, overall. To say we need some weakness is an understatement. We're pushing our bet a little hard right now. But the fragility that showed Tuesday afternoon gives us confidence that the market is skating on thin ice.

Moving to our charts:

1) We're pretty short of housing stocks (9%) and shared a chart yesterday showing housing starts being weak. That's not translating into Mortgage Purchase Applications, which means people are buying pre-existing homes. Perhaps there will be a lagging effect as people move into temporary, existing homes before building a house? Perhaps it means the housing market is actually not so weak - but newly built homes will suffer?

2) This chart shows Central Bank holdings of government bonds. Basically, the government issuing bonds to themselves. Japan's central bank owns nearly 1/2 of all government debt! At some point, does the debt exist if we're issuing it to ourselves?

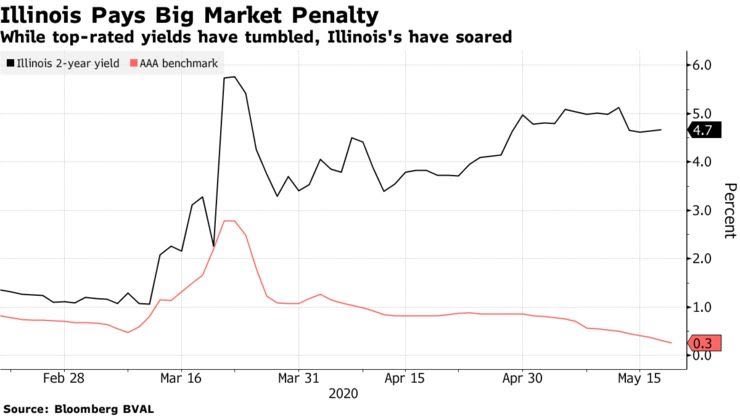

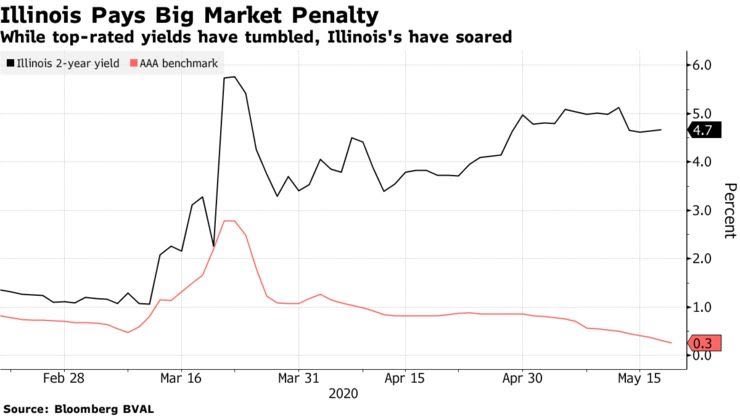

3) Finally, as we've discussed a few times in various ways - credit spreads are blowing out. So while sovereign yields are falling, higher credit spreads mean actual borrowing costs aren't falling for companies, individuals, and states. Junk-rated Illinois can borrow 2-year money at nearly 5% despite the 2-year Treasury yielding just 0.3%. You can see credit spreads were much tighter back in February, at the far left of the graph, and haven't fallen as sovereign yields fell. Rising credit spreads are a sign of expected weakness. Bond markets are considered smarter than equity markets.

We're very bearishly positioned heading into the day. Depending on how markets trade, we might change the exposure pretty quickly. Being 20% short isn't something you do for long stretches of time or with a long leash.

We're beginning to worry that it's going to take a long time for investors to come to the same conclusion that we have - that the future isn't as bright as it was 3 months ago, the present is far worse than we think, and more spending and intervention by central banks has consequences.

But maybe that's the fear talking.

Stocks finished up 1.67% yesterday, as measured by the S&P 500. We took the up day as an opportunity to cut our net and gross exposure by 9%. We're sitting at 21% net short of equities and 57% gross exposed, overall. To say we need some weakness is an understatement. We're pushing our bet a little hard right now. But the fragility that showed Tuesday afternoon gives us confidence that the market is skating on thin ice.

Moving to our charts:

1) We're pretty short of housing stocks (9%) and shared a chart yesterday showing housing starts being weak. That's not translating into Mortgage Purchase Applications, which means people are buying pre-existing homes. Perhaps there will be a lagging effect as people move into temporary, existing homes before building a house? Perhaps it means the housing market is actually not so weak - but newly built homes will suffer?

2) This chart shows Central Bank holdings of government bonds. Basically, the government issuing bonds to themselves. Japan's central bank owns nearly 1/2 of all government debt! At some point, does the debt exist if we're issuing it to ourselves?

3) Finally, as we've discussed a few times in various ways - credit spreads are blowing out. So while sovereign yields are falling, higher credit spreads mean actual borrowing costs aren't falling for companies, individuals, and states. Junk-rated Illinois can borrow 2-year money at nearly 5% despite the 2-year Treasury yielding just 0.3%. You can see credit spreads were much tighter back in February, at the far left of the graph, and haven't fallen as sovereign yields fell. Rising credit spreads are a sign of expected weakness. Bond markets are considered smarter than equity markets.

We're very bearishly positioned heading into the day. Depending on how markets trade, we might change the exposure pretty quickly. Being 20% short isn't something you do for long stretches of time or with a long leash.

We're beginning to worry that it's going to take a long time for investors to come to the same conclusion that we have - that the future isn't as bright as it was 3 months ago, the present is far worse than we think, and more spending and intervention by central banks has consequences.

But maybe that's the fear talking.

Comments

Post a Comment