Before moving into the markets, I just want to give an update on my Lenovo Chromebook Duet. I've been talking about it here for almost a week and finally got it delivered yesterday. Like all Chromebooks, it was easy to get signed in an running - since everything is in the cloud. The screen is sharp and bright. The keyboard/trackpad works great. Some of the keys are a little small, but after a little practice, you get used to it. For $249 at Walmart, it's a steal of a device. It can be disconnected to be just a tablet for when you're surfing home listings on the couch or whatever it is that you do at night ;) I've been using an iPad with a keyboard for notes and typing (as my secondary device) for years. I brought it to meetings all across the world - but the limitations of an iPad is that it's a tablet. This Lenovo Chromebook Duet has a full, desktop internet browser (Chrome), and is therefore way more useful and natural to use. Seriously, if you need a second device and are pretty into Chrome and Google services, this thing is a steal.

After opening in the red, stocks turned green following remarks from President Trump about more stimulus checks to people. There were a few failed attempts to sell off again, but it didn't hold. Stocks finished at the highs of the day.

The big news overnight was obviously when futures crashed following remarks about the China deal being over from Peter Navarro, Trump's Trade Advisor. He and Trump quickly walked back the comments saying Phase I of the trade deal is going, but future phases might be questionable. Futures then came back pretty quickly - though perhaps that was also Mnuchin's nightly purchase.

Something that's been trending in the news is the end-of-month pension rebalance. And end-of-quarter! With how much stocks have run up, the selling pressure will be pretty massive. It might be one of the million cuts that finally starts to push equity prices down. Stay tuned on this.

________________________________________

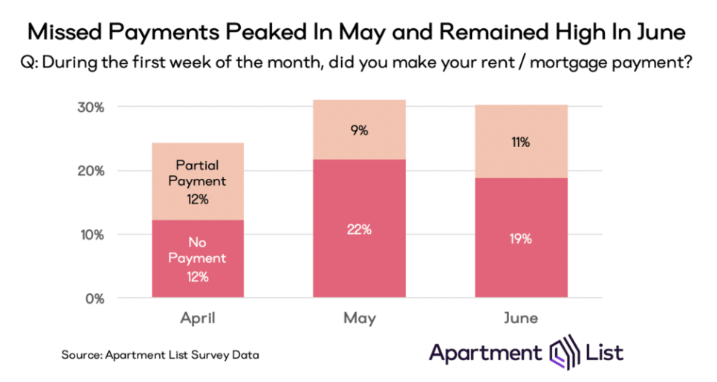

1) 30% of people didn't pay their full mortgage/rent in June - about the same as in May.

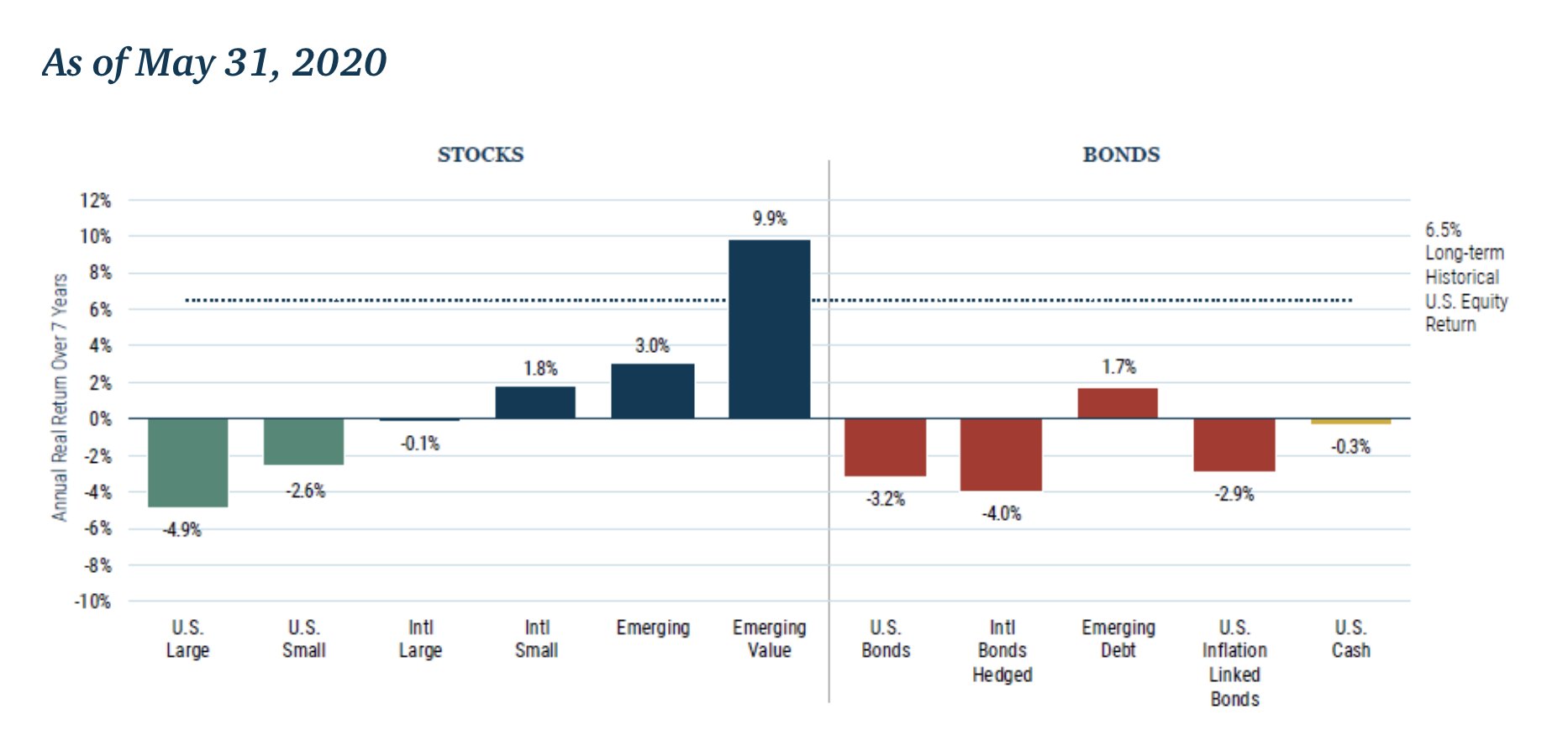

2) This is a forecast for annual returns over the next 7 years from GMO. Note that US equities are expected to provide negative returns. Even bonds! Emerging market value is the only asset class that will provide above average returns. Something to ponder.

3) Central bank liquidity swaps. Used in times of turmoil. Obviously to some, this is a major time of turmoil. The tool's use is at higher levels than 2009. Not good news.

_________________________________________________

I sold my GDX position yesterday after gold jumped and gold miners too. It was a position I put on to get equity exposure at a time when I had no good ideas. With an abundance of utility ideas, getting equity exposure isn't such a problem now - so I sold GDX at a small loss and will move on. To offset the sale, I closed the regional banks short for a modest gain. I also sold Kroger early in the day after buying it when shares plunged following an amazing quarterly report.

To finish up the day, I shorted Apple. It looks extended on the charts and is no longer a cheap stock. Their products aren't cheap either - and I don't get the value proposition. Heck, using a $249 Lenovo Chromebook puts me far away from needing a Macbook - and I switched to an Android phone 5 years ago due to cost.

My goal this week was to add Sempra. I also wanted to maintain or reduce my net utility exposure and total gross exposure. I now have room to buy SRE and short something else. I didn't think I'd get an opportunity to drop GDX (and cover KRE) so now have an extra ~10% gross exposure to work with. I might get Sempra into the rotation with an offsetting short today.

After opening in the red, stocks turned green following remarks from President Trump about more stimulus checks to people. There were a few failed attempts to sell off again, but it didn't hold. Stocks finished at the highs of the day.

The big news overnight was obviously when futures crashed following remarks about the China deal being over from Peter Navarro, Trump's Trade Advisor. He and Trump quickly walked back the comments saying Phase I of the trade deal is going, but future phases might be questionable. Futures then came back pretty quickly - though perhaps that was also Mnuchin's nightly purchase.

Something that's been trending in the news is the end-of-month pension rebalance. And end-of-quarter! With how much stocks have run up, the selling pressure will be pretty massive. It might be one of the million cuts that finally starts to push equity prices down. Stay tuned on this.

________________________________________

1) 30% of people didn't pay their full mortgage/rent in June - about the same as in May.

2) This is a forecast for annual returns over the next 7 years from GMO. Note that US equities are expected to provide negative returns. Even bonds! Emerging market value is the only asset class that will provide above average returns. Something to ponder.

3) Central bank liquidity swaps. Used in times of turmoil. Obviously to some, this is a major time of turmoil. The tool's use is at higher levels than 2009. Not good news.

_________________________________________________

I sold my GDX position yesterday after gold jumped and gold miners too. It was a position I put on to get equity exposure at a time when I had no good ideas. With an abundance of utility ideas, getting equity exposure isn't such a problem now - so I sold GDX at a small loss and will move on. To offset the sale, I closed the regional banks short for a modest gain. I also sold Kroger early in the day after buying it when shares plunged following an amazing quarterly report.

To finish up the day, I shorted Apple. It looks extended on the charts and is no longer a cheap stock. Their products aren't cheap either - and I don't get the value proposition. Heck, using a $249 Lenovo Chromebook puts me far away from needing a Macbook - and I switched to an Android phone 5 years ago due to cost.

My goal this week was to add Sempra. I also wanted to maintain or reduce my net utility exposure and total gross exposure. I now have room to buy SRE and short something else. I didn't think I'd get an opportunity to drop GDX (and cover KRE) so now have an extra ~10% gross exposure to work with. I might get Sempra into the rotation with an offsetting short today.

Comments

Post a Comment