Buying SRE @ $114.83

Adding 2%

4% position

I sold two 1% utility positions to add more to Sempra, a top-pick company. I think, with high confidence, that Sempra is worth $145+/share.

Sempra Energy is one of the best capital allocators in the utility and energy infrastructure space. They aren't afraid to be ahead of the curve and take bold bets. For example, they were way ahead of the LNG export game. They diversified into Latin America before values skyrocketed, and then got out. They doubled down into regulated utilities when others were selling. They know what they are supposed to do and do it well.

It's no wonder Avangrid (AGR) stole an executive from Sempra!

This is an excerpt from an article I wrote a year ago, but is still relevant:

Adding 2%

4% position

I sold two 1% utility positions to add more to Sempra, a top-pick company. I think, with high confidence, that Sempra is worth $145+/share.

Sempra Energy is one of the best capital allocators in the utility and energy infrastructure space. They aren't afraid to be ahead of the curve and take bold bets. For example, they were way ahead of the LNG export game. They diversified into Latin America before values skyrocketed, and then got out. They doubled down into regulated utilities when others were selling. They know what they are supposed to do and do it well.

It's no wonder Avangrid (AGR) stole an executive from Sempra!

This is an excerpt from an article I wrote a year ago, but is still relevant:

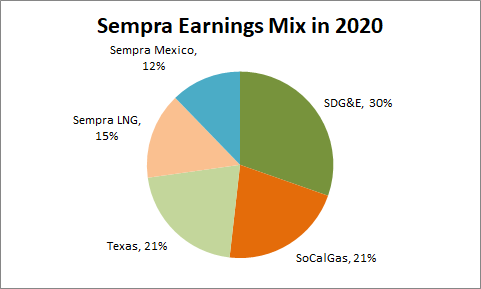

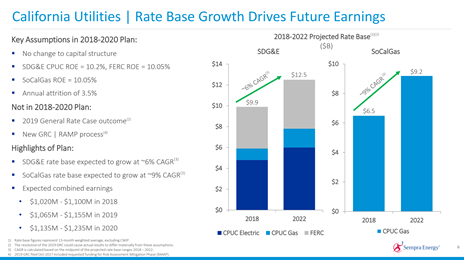

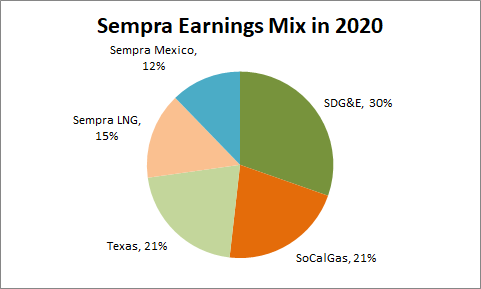

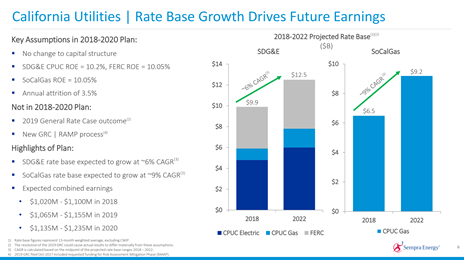

SDG&E: San Diego Gas & Electric is a natural gas & electric utility that provides services to San Diego and the surrounding areas.

SoCalGas: Southern California Gas is a natural gas utility that provides natural gas service to most of Southern California.

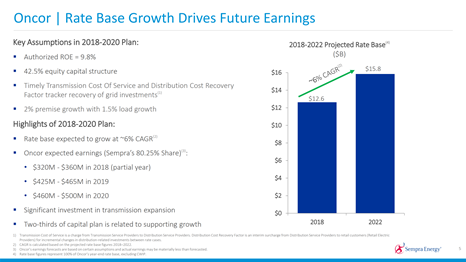

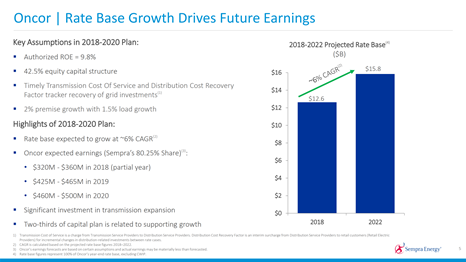

Texas: Includes Oncor, a large electric utility in Texas, and InfraREIT, a quickly growing electric transmission company with a similar footprint, also in Texas.

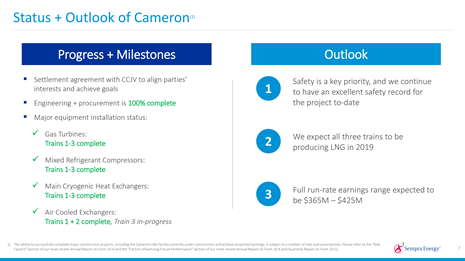

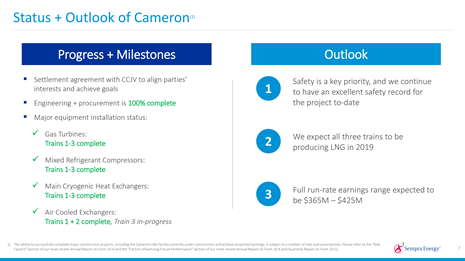

Sempra LNG: Cameron LNG, a major LNG export facility on the U.S. Gulf Coast with long-term contracts and growth potential.

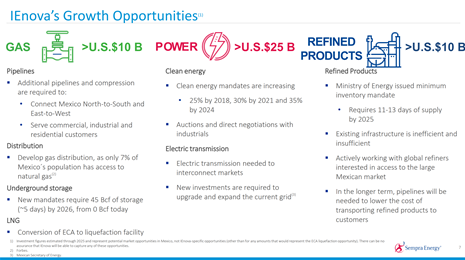

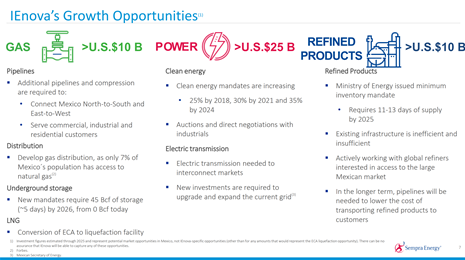

Sempra Mexico: Includes Sempra's ownership of IEnova, a publicly-traded energy midstream company in Mexico.

What differentiates Sempra's earnings mix from others is the growth potential and favorable regulatory environments.

California has long been considered one of the best places to be a utility. They have forward-looking test years, a history of above-average allowed returns, and population growth - which together form a wonderful backdrop to be a utility.

Similarly, Texas has a growing population and therefore growing energy needs. This sets the tone for favorable regulation to entice continued infrastructure build to meet customer demand.

Notice the theme here? Growing energy needs necessitate favorable regulation. That's the secret to Sempra's success. Being in favorable places to do business that are growing. This makes for a great utility-centric investment. The non-utility businesses are the growth kicker!

___________________________________

I wrote this article on SeekingAlpha.com on 3/1/2019. I estimated SRE to be worth $145/share. Even if I'm off by 10%, there's still upside. And in today's overpriced market, that's good enough for me!

| Sempra Valuation | |||

| EPS | P/E | Value | |

| Sempra California Utilities | 4.03 | 19.6 | 78.99 |

| Sempra Texas Utilities | 1.87 | 19.6 | 36.65 |

| Sempra LNG | 1.16 | 18.6 | 21.58 |

| Sempra Mexico | 0.95 | 13.9 | 13.28 |

| Parent | (1.77) | 12.0 | (21.24) |

| Renewables/S. America | 0.85 | 18.6 | 15.81 |

| Total | 7.09 | 20.5 | 145.07 |

Comments

Post a Comment