Happy birthday weekend to my dad!

The bank stress tests were revealed - with limits on buybacks and dividends. Good news, obviously....

Futures are flat to down this morning before the open.

Short note, late start today.

_____________________________________________________________

1) Stock correlations are still really high. That means they all move together - a macro trade - instead of moving on company fundamentals.

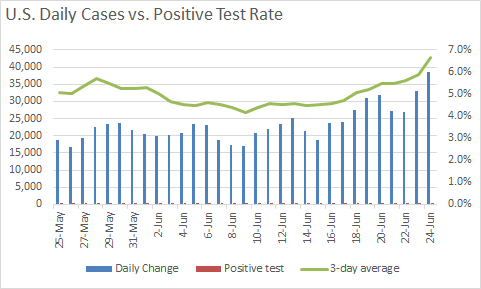

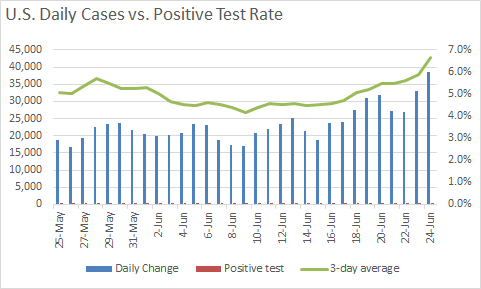

2) It's a bit hard to see, but the little red line is the % of positive tests. It was 7.7% - the highest since May 10th. Number of tests are up 60% since then. More testing leads to more cases - but a higher positive rate is worrying.

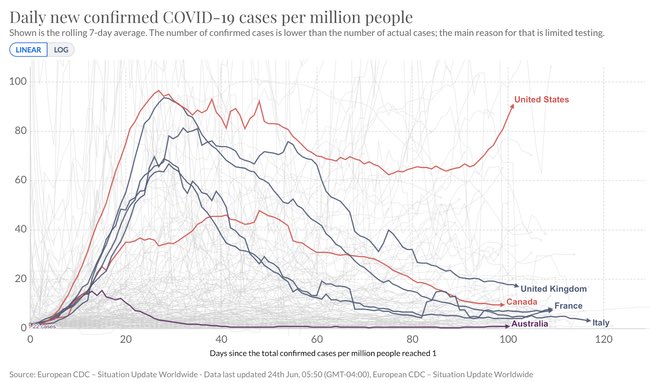

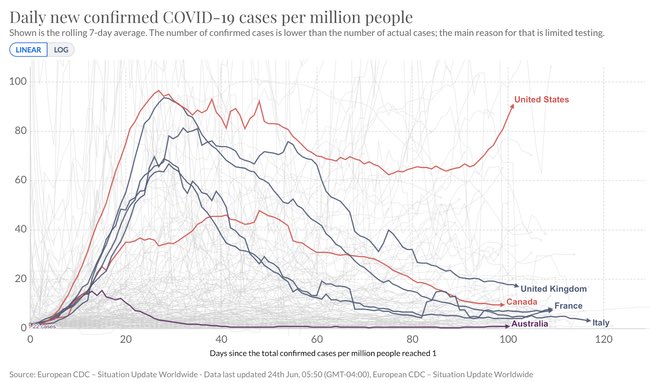

3) Not to keep harping on the coronavirus, but it seems to have been pushed to the backburner by a lot of folks. It's still very much here and very real. This chart is a damning one for our response - specifically on President Trump. Why haven't our case numbers fallen like the rest of the world? Why are we not panicking now, with daily cases higher than ever? The "no mask" crowd is absurd. They aren't good at math.

____________________________________________________________

Yesterday, I reduced gross exposure by closing the DLR/IRM vs. VNQ double pair trade at a slight gain. That's 9% of gross exposure reduction!

A lot of utilities and renewable energy companies are looking pretty good - and might be good longs against tech and financial shorts.

If you haven't bought AWK, it's gotten punished and is below my cost basis.

One more day to grind before the weekend!

The bank stress tests were revealed - with limits on buybacks and dividends. Good news, obviously....

Futures are flat to down this morning before the open.

Short note, late start today.

_____________________________________________________________

1) Stock correlations are still really high. That means they all move together - a macro trade - instead of moving on company fundamentals.

2) It's a bit hard to see, but the little red line is the % of positive tests. It was 7.7% - the highest since May 10th. Number of tests are up 60% since then. More testing leads to more cases - but a higher positive rate is worrying.

3) Not to keep harping on the coronavirus, but it seems to have been pushed to the backburner by a lot of folks. It's still very much here and very real. This chart is a damning one for our response - specifically on President Trump. Why haven't our case numbers fallen like the rest of the world? Why are we not panicking now, with daily cases higher than ever? The "no mask" crowd is absurd. They aren't good at math.

____________________________________________________________

Yesterday, I reduced gross exposure by closing the DLR/IRM vs. VNQ double pair trade at a slight gain. That's 9% of gross exposure reduction!

A lot of utilities and renewable energy companies are looking pretty good - and might be good longs against tech and financial shorts.

If you haven't bought AWK, it's gotten punished and is below my cost basis.

One more day to grind before the weekend!

Comments

Post a Comment