Happy Fathers Day! I'll be seeing my dad later today. My kids have been asking if it's Fathers Day for the last 4 or 5 days, so the fact that it's finally here will make them relieved.

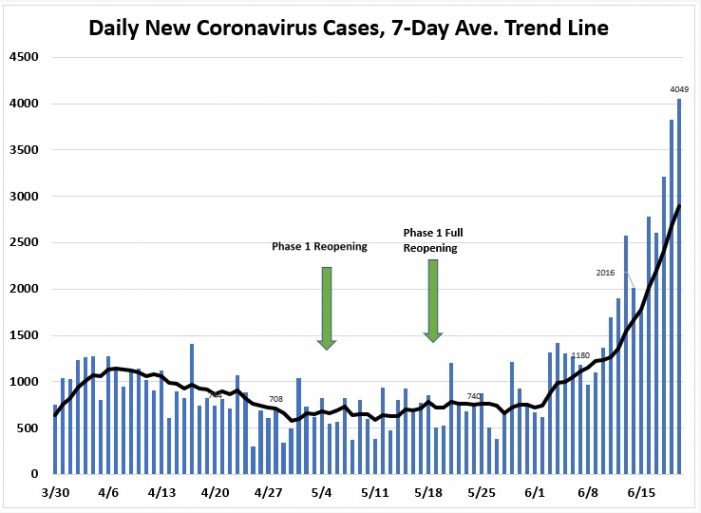

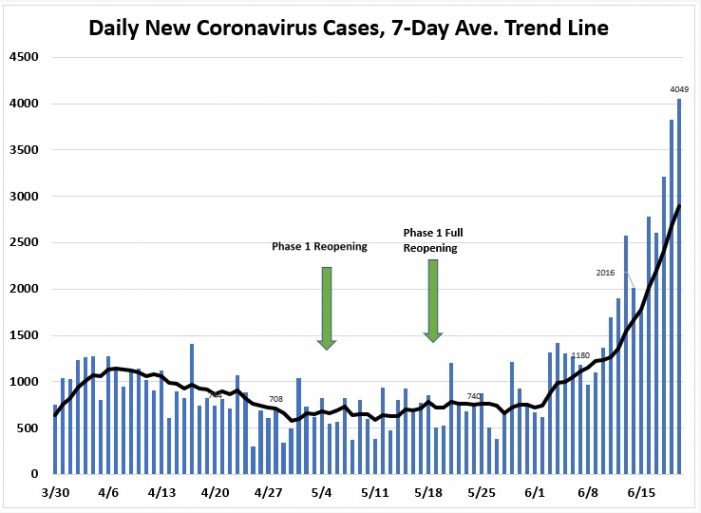

The big news items yesterday were Trump's rally and the continued spiking coronavirus cases in Florida, Texas, Arizona, and California. Below is Florida, but it's representative of most of the re-opened states.

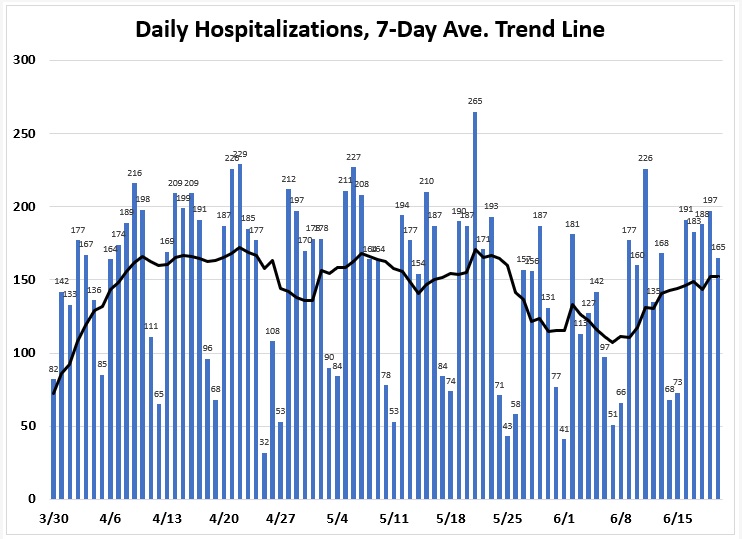

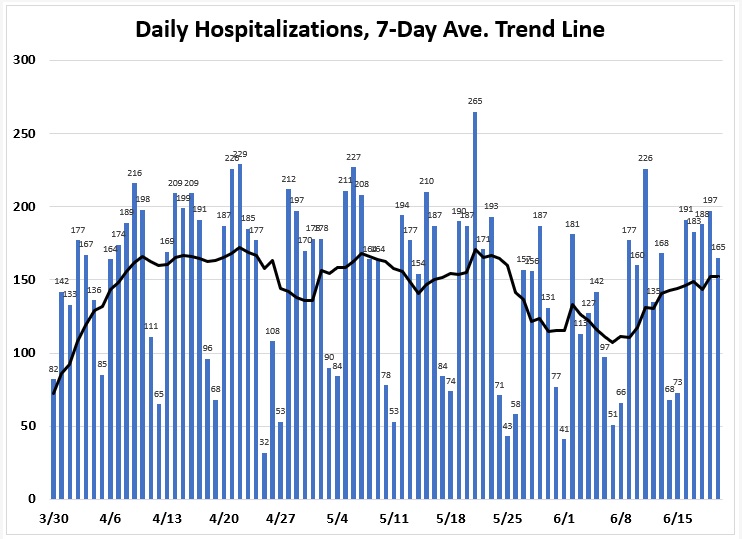

Florida's governor even walked back comments that testing is driving the new cases - after hospitals began reporting being at/near capacity - something I talked about in Texas last week at some point. Hospitalizations are a pure way to measure the virus's spread - it's not dependent on testing. Just like "excess deaths" is a clean way to look at how many people have died - and remove the fudging of numbers that can happen. "Excess deaths" are something like 80,000 vs. a reported death toll of 100,000+. So there's some amount of gaming that happens, but the virus truly is deadly.

Trump's rally was supposed to be jam-packed. Like record-breaking crowds inside and outside. That ended up not being the case. It was a large crowd, for sure. But not what was expected. And that's a great example of how Trump operates. He sets expectations beyond even the high end of real.

Had Trump said nothing about the expected crowd, it would have been a non-event. Maybe even a positive surprise. The CNN reported talked about how it was a huge crowd for a political rally. But Trump pushed the narrative that it would be packed to the gills, overflowing, etc. So that's where the reporting narrative went. It's probably for the best because his speech was pretty divisive and lackluster. He's doubling down on his 2016 strategy of division and hate. I think that's a complete misread of how to win in 2020, but we'll see in November.

_____________________________________________________________

Last week was another positive week for stocks - both in the US and around the world.

U.S. Indices

Dow +1.1% to 25,871. S&P 500 +1.9% to 3,098. Nasdaq +3.7% to 9,946. Russell 2000 +2.4% to 1,421. CBOE Volatility Index -2.7% to 35.12.

S&P 500 Sectors

Consumer Staples +3.%. Utilities +0.7%. Financials +1.3%. Telecom +2.3%. Healthcare +2.2%. Industrials +1.9%. Information Technology +3.6%. Materials +2.3%. Energy +0.7%. Consumer Discretionary +2.8%.

World Indices

London +3.1% to 6,293. France +2.9% to 4,979. Germany +3.2% to 12,331. Japan +0.8% to 22,479. China +1.6% to 2,968. Hong Kong +1.4% to 24,644. India +2.8% to 34,732.

Commodities and Bonds

Crude Oil WTI +8.9% to $39.45/bbl. Gold +1.% to $1,754.3/oz. Natural Gas -3.5% to 1.669. Ten-Year Treasury Yield -0.2% to 138.79.

Forex and Cryptos

EUR/USD -0.73%. USD/JPY -0.46%. GBP/USD -1.53%. Bitcoin -1.8%. Litecoin -3.9%. Ethereum -3.5%. Ripple -3.1%.

_________________________________________

Apple's WWDC event is this week - with the widely speculated switch from Intel to ARM processors in their Macbooks. I won't pretend to know the implications of it, from a coding perspective, but it's a sign that Intel's margins might be too high.

In somewhat related news, I've been using an old Windows 8 Asus computer as my second screen and computer for the last few weeks. I found a way to upgrade to Windows 10, which made it far more useful, but it is slow, laggy, and has a horrible screen. My wife uses Chromebooks exclusively, and for my other screen, a Chromebook would be a great fit. I bought her a really great Chromebook last year for $400. But Chromebook prices are obscene ever since the stay-at-home and e-learning began. The same computer I got for her is now $550+!

Thankfully, Lenovo has our backs and came out with two solid choices. One is basically my wife's Chromebook - a 13.3" clamshell style traditional laptop. However, it's still $400. The other choice is a tablet with a keyboard for $279. I've been using an iPad with a keyboard since 2013, so that form-factor is very familiar to me. My iPad can no longer be used for productivity - it's too slow and lacks a trackpad/mouse. It's great for watching videos and playing iOS games, but has gotten too slow to even surf the internet! My iPad/keyboard setup cost like $750 back in the day and would be comparable now. If I was more into the Apple ecosystem, it might make sense - but I switched to an Android phone in 2016 and am fully integrated into the Google world.

Long story long, I ordered the Lenovo Chromebook Duet from Walmart for $249. That price is worth it just to replace the iPad, let alone as a second computer/productivity device. It arrives tomorrow, and I'll write a brief note about it in case you're in need of a secondary device - but all of the reviews are pretty great - for the price.

Chrome OS is pretty awesome - I've seen what it can do from my wife - and most of what I do on a computer is inside of a browser. If you haven't used Google Sheets lately, it's 95% as good as Microsoft Excel. And I'm an Excel power-user - it was my job to build company models in Excel for 8 years. So for me to say Sheets is that good is a big statement. I could go full Chromebook if Schwab's StreetSmart Edge wasn't a Windows program. (It can be used in a browser, but uses Citrix to create a virtual computer and has horrible reviews.) Try staying inside of your browser for a few days to see if a Chromebook is for you. You'll be surprised.

________________________________________________________

To kick off the week ahead, let's stay focused on the Central Bank - where balance sheets and money supply are at all-time highs.

Any money supply/Fed balance sheet charts are reason to own gold. And TIPS. This week, I sold my Extended Duration treasuries to buy TIPs. I'm patiently waiting another opportunity to push my GLD holdings from 5% to 15% like I did a few weeks ago. This easy money, balance sheet expansion has dire consequences - and inflation is coming at some point.

The dollar has turned pretty weak because our central bank in the US is easing more aggressively than other central banks that either have been easing longer (Japan) or aren't easing as much (UK/EU). Weak dollar is also good for gold as it will take more dollars to buy the same amount of gold.

_____________________________________________________________

The plan this week is the same as last week - try to reduce gross exposure and rotate the 1% utility positions into more concentrated utility positions. Sempra (SRE) is flashing buy signals and might replace some of the smaller utilities - rather than sell one to add to another (D/CMS/AQN/FTS/PCG). But we'll see what hand we're dealt tomorrow and beyond.

The VIX is still well into the 30s. That's a harbinger of a major move downward, so any repositioning will be done through the lens of remaining modestly net short of equities.

I've been short equities since this blog began. I started it to help guide readers through the coming volatility. It's been the wrong call so far. Heck, I pivoted from being heavily net short to barely short a few weeks ago. Basically throwing in the towel. But the VIX staying up here gives me confidence that it might be time to push shorts again. It just takes one person rushing out the door to start the stampede.

So if you're long of equities, tread lightly. If you're neutral or short, stay nimble and prepare to be paid. But don't push bets too hard - "the market can stay irrational longer than you can stay solvent."

Best of luck this week. And Happy Fathers Day! I'm off to enjoy it with my kids.

The big news items yesterday were Trump's rally and the continued spiking coronavirus cases in Florida, Texas, Arizona, and California. Below is Florida, but it's representative of most of the re-opened states.

Florida's governor even walked back comments that testing is driving the new cases - after hospitals began reporting being at/near capacity - something I talked about in Texas last week at some point. Hospitalizations are a pure way to measure the virus's spread - it's not dependent on testing. Just like "excess deaths" is a clean way to look at how many people have died - and remove the fudging of numbers that can happen. "Excess deaths" are something like 80,000 vs. a reported death toll of 100,000+. So there's some amount of gaming that happens, but the virus truly is deadly.

Trump's rally was supposed to be jam-packed. Like record-breaking crowds inside and outside. That ended up not being the case. It was a large crowd, for sure. But not what was expected. And that's a great example of how Trump operates. He sets expectations beyond even the high end of real.

Had Trump said nothing about the expected crowd, it would have been a non-event. Maybe even a positive surprise. The CNN reported talked about how it was a huge crowd for a political rally. But Trump pushed the narrative that it would be packed to the gills, overflowing, etc. So that's where the reporting narrative went. It's probably for the best because his speech was pretty divisive and lackluster. He's doubling down on his 2016 strategy of division and hate. I think that's a complete misread of how to win in 2020, but we'll see in November.

_____________________________________________________________

Last week was another positive week for stocks - both in the US and around the world.

U.S. Indices

Dow +1.1% to 25,871. S&P 500 +1.9% to 3,098. Nasdaq +3.7% to 9,946. Russell 2000 +2.4% to 1,421. CBOE Volatility Index -2.7% to 35.12.

S&P 500 Sectors

Consumer Staples +3.%. Utilities +0.7%. Financials +1.3%. Telecom +2.3%. Healthcare +2.2%. Industrials +1.9%. Information Technology +3.6%. Materials +2.3%. Energy +0.7%. Consumer Discretionary +2.8%.

World Indices

London +3.1% to 6,293. France +2.9% to 4,979. Germany +3.2% to 12,331. Japan +0.8% to 22,479. China +1.6% to 2,968. Hong Kong +1.4% to 24,644. India +2.8% to 34,732.

Commodities and Bonds

Crude Oil WTI +8.9% to $39.45/bbl. Gold +1.% to $1,754.3/oz. Natural Gas -3.5% to 1.669. Ten-Year Treasury Yield -0.2% to 138.79.

Forex and Cryptos

EUR/USD -0.73%. USD/JPY -0.46%. GBP/USD -1.53%. Bitcoin -1.8%. Litecoin -3.9%. Ethereum -3.5%. Ripple -3.1%.

_________________________________________

Apple's WWDC event is this week - with the widely speculated switch from Intel to ARM processors in their Macbooks. I won't pretend to know the implications of it, from a coding perspective, but it's a sign that Intel's margins might be too high.

In somewhat related news, I've been using an old Windows 8 Asus computer as my second screen and computer for the last few weeks. I found a way to upgrade to Windows 10, which made it far more useful, but it is slow, laggy, and has a horrible screen. My wife uses Chromebooks exclusively, and for my other screen, a Chromebook would be a great fit. I bought her a really great Chromebook last year for $400. But Chromebook prices are obscene ever since the stay-at-home and e-learning began. The same computer I got for her is now $550+!

Thankfully, Lenovo has our backs and came out with two solid choices. One is basically my wife's Chromebook - a 13.3" clamshell style traditional laptop. However, it's still $400. The other choice is a tablet with a keyboard for $279. I've been using an iPad with a keyboard since 2013, so that form-factor is very familiar to me. My iPad can no longer be used for productivity - it's too slow and lacks a trackpad/mouse. It's great for watching videos and playing iOS games, but has gotten too slow to even surf the internet! My iPad/keyboard setup cost like $750 back in the day and would be comparable now. If I was more into the Apple ecosystem, it might make sense - but I switched to an Android phone in 2016 and am fully integrated into the Google world.

Long story long, I ordered the Lenovo Chromebook Duet from Walmart for $249. That price is worth it just to replace the iPad, let alone as a second computer/productivity device. It arrives tomorrow, and I'll write a brief note about it in case you're in need of a secondary device - but all of the reviews are pretty great - for the price.

Chrome OS is pretty awesome - I've seen what it can do from my wife - and most of what I do on a computer is inside of a browser. If you haven't used Google Sheets lately, it's 95% as good as Microsoft Excel. And I'm an Excel power-user - it was my job to build company models in Excel for 8 years. So for me to say Sheets is that good is a big statement. I could go full Chromebook if Schwab's StreetSmart Edge wasn't a Windows program. (It can be used in a browser, but uses Citrix to create a virtual computer and has horrible reviews.) Try staying inside of your browser for a few days to see if a Chromebook is for you. You'll be surprised.

________________________________________________________

To kick off the week ahead, let's stay focused on the Central Bank - where balance sheets and money supply are at all-time highs.

Any money supply/Fed balance sheet charts are reason to own gold. And TIPS. This week, I sold my Extended Duration treasuries to buy TIPs. I'm patiently waiting another opportunity to push my GLD holdings from 5% to 15% like I did a few weeks ago. This easy money, balance sheet expansion has dire consequences - and inflation is coming at some point.

The dollar has turned pretty weak because our central bank in the US is easing more aggressively than other central banks that either have been easing longer (Japan) or aren't easing as much (UK/EU). Weak dollar is also good for gold as it will take more dollars to buy the same amount of gold.

_____________________________________________________________

The plan this week is the same as last week - try to reduce gross exposure and rotate the 1% utility positions into more concentrated utility positions. Sempra (SRE) is flashing buy signals and might replace some of the smaller utilities - rather than sell one to add to another (D/CMS/AQN/FTS/PCG). But we'll see what hand we're dealt tomorrow and beyond.

The VIX is still well into the 30s. That's a harbinger of a major move downward, so any repositioning will be done through the lens of remaining modestly net short of equities.

I've been short equities since this blog began. I started it to help guide readers through the coming volatility. It's been the wrong call so far. Heck, I pivoted from being heavily net short to barely short a few weeks ago. Basically throwing in the towel. But the VIX staying up here gives me confidence that it might be time to push shorts again. It just takes one person rushing out the door to start the stampede.

So if you're long of equities, tread lightly. If you're neutral or short, stay nimble and prepare to be paid. But don't push bets too hard - "the market can stay irrational longer than you can stay solvent."

Best of luck this week. And Happy Fathers Day! I'm off to enjoy it with my kids.

Comments

Post a Comment