The reality of the economy can't be ignored by stocks forever. Why do we need more stimulus, something the White House is pushing, when jobs are growing at the fastest rate ever and the economy is "growing like we've never seen before"?

Markets rallied yesterday on more vaccine hopes. This time from AstraZeneca and Pfizer. We don't sell off when vaccines aren't the answer - only rally on the "hopes". If that makes sense to you, let me know.

The Nasdaq was up particularly more than the rest yesterday driven by Tesla (+~9%) and Amazon (+~7%). Google even joined the party up ~3%. I fought the urge to short the QQQ late in the day. I think I'll regret not making the move.

__________________________________________________

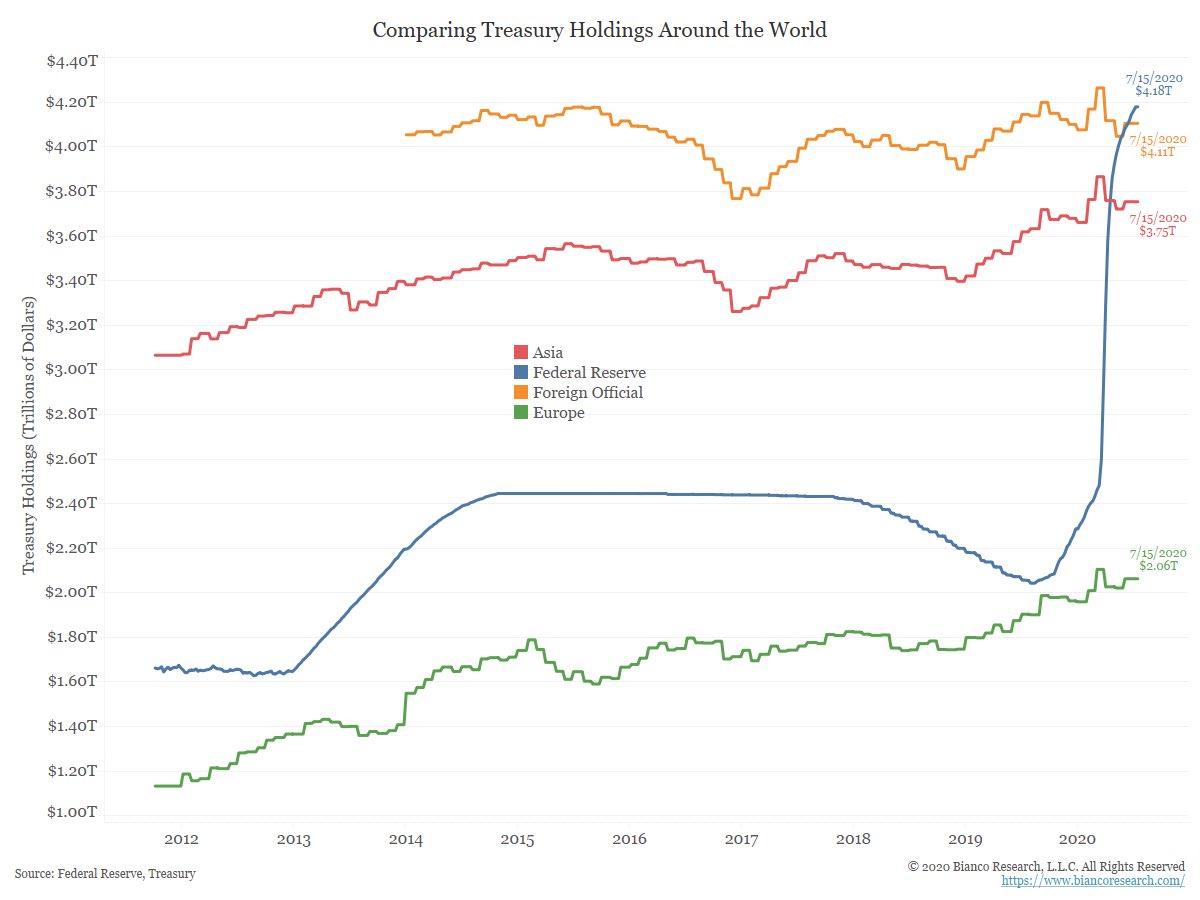

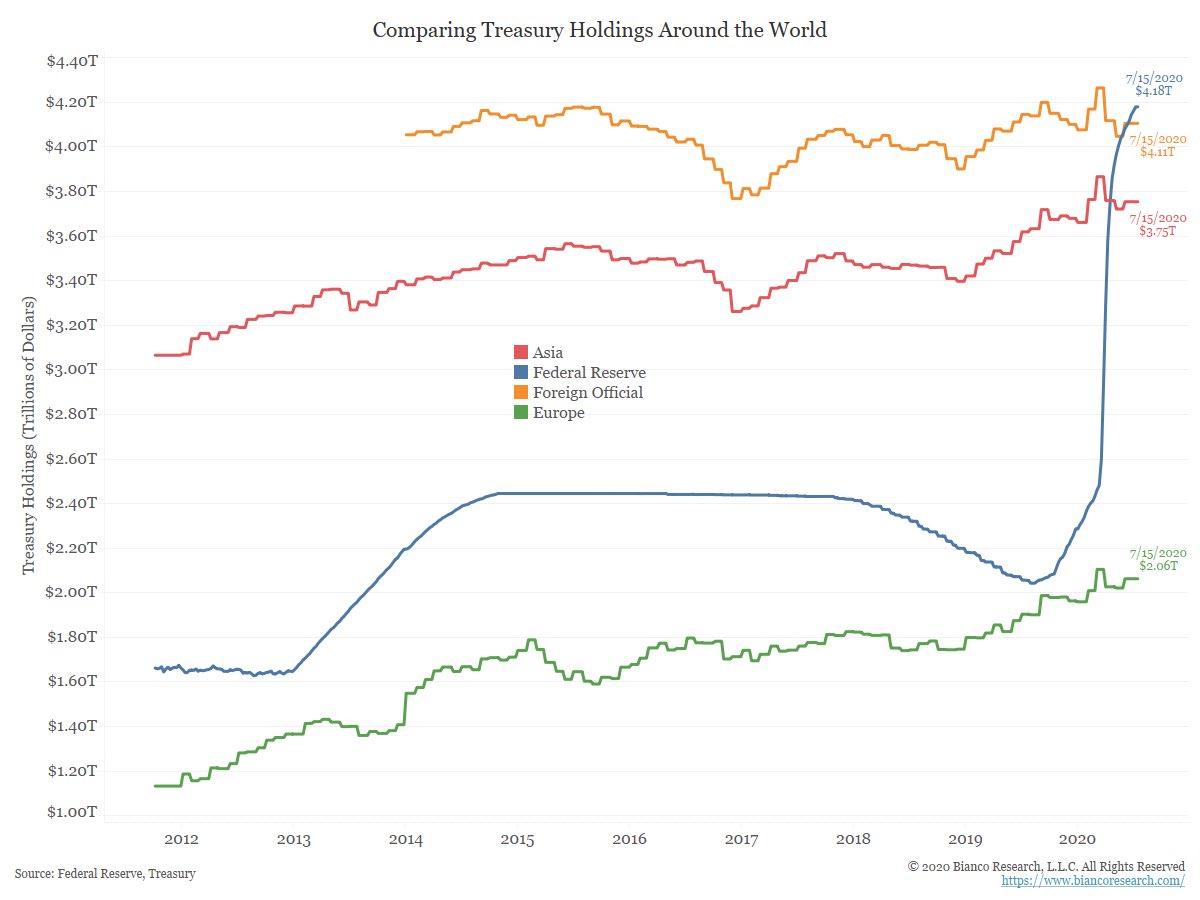

1) Good news! China is no longer the largest holder of our (US) debt! Yay! Bad news...we own our own debt...does it even exist if we own it? Doesn't that add to zero if we sell it and buy it?

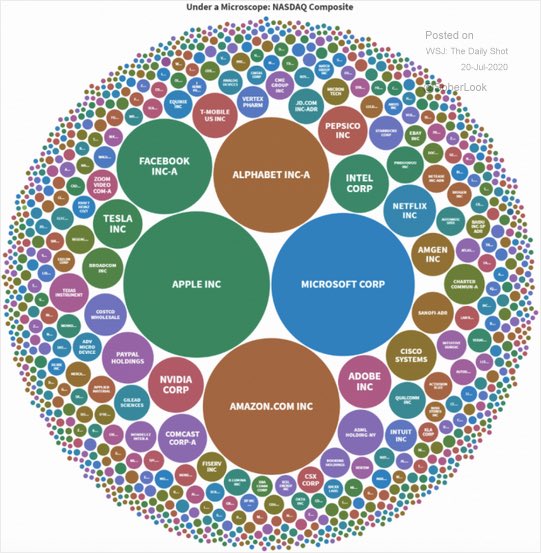

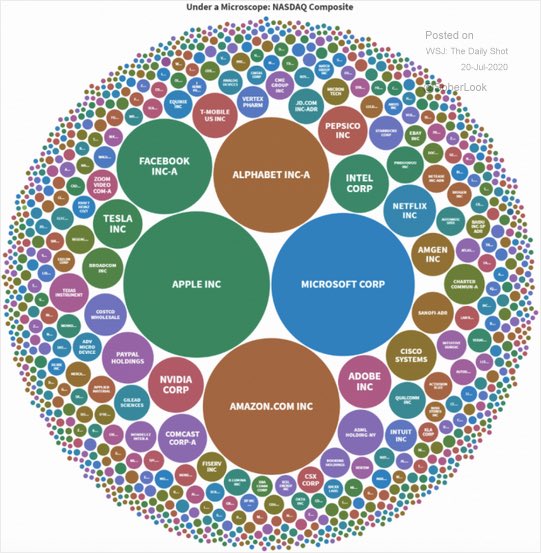

2) It never hurts to find new ways to understand how the indexes are constructed. This one is pretty cool.

3) More managers than "normal" are beating their benchmarks thanks to the volatility. Most managers tend to be overly bullish, so it's not too surprising that performance has beaten benchmarks since April. Still, interesting.

__________________________________________________

One of the few tech stocks on my buy list is Cisco Systems. It's one that's perpetually cheap but with all of the attributes that make tech stocks so attractive. Strong balance sheet, scale-able business, etc. But it also has utility-like attributes - reasonable valuation, good dividend yield, and low(ish) risk business model. I may add it in the next few days or weeks, depending. So be forewarned.

The little pair trade I made yesterday with Chevron vs. Conoco was nice. making over 1% on a 10% position size in a day is awesome! It doesn't sound like much, but if it happened every day, it would mean a ~20% annual return on 100% of your capital by using just 10% of it. That's the power of actively managing positions.

Who knows what today holds? I'm ready for anything and will be looking for another shot to make some more fast money.

Markets rallied yesterday on more vaccine hopes. This time from AstraZeneca and Pfizer. We don't sell off when vaccines aren't the answer - only rally on the "hopes". If that makes sense to you, let me know.

The Nasdaq was up particularly more than the rest yesterday driven by Tesla (+~9%) and Amazon (+~7%). Google even joined the party up ~3%. I fought the urge to short the QQQ late in the day. I think I'll regret not making the move.

__________________________________________________

1) Good news! China is no longer the largest holder of our (US) debt! Yay! Bad news...we own our own debt...does it even exist if we own it? Doesn't that add to zero if we sell it and buy it?

2) It never hurts to find new ways to understand how the indexes are constructed. This one is pretty cool.

3) More managers than "normal" are beating their benchmarks thanks to the volatility. Most managers tend to be overly bullish, so it's not too surprising that performance has beaten benchmarks since April. Still, interesting.

__________________________________________________

One of the few tech stocks on my buy list is Cisco Systems. It's one that's perpetually cheap but with all of the attributes that make tech stocks so attractive. Strong balance sheet, scale-able business, etc. But it also has utility-like attributes - reasonable valuation, good dividend yield, and low(ish) risk business model. I may add it in the next few days or weeks, depending. So be forewarned.

The little pair trade I made yesterday with Chevron vs. Conoco was nice. making over 1% on a 10% position size in a day is awesome! It doesn't sound like much, but if it happened every day, it would mean a ~20% annual return on 100% of your capital by using just 10% of it. That's the power of actively managing positions.

Who knows what today holds? I'm ready for anything and will be looking for another shot to make some more fast money.

If we hold our own debt, does that lessen the burden to pay it back? Couldn't we even do a WWII like program to encourage citizens to buy Federal T-bills so everyone had a skin in the game?

ReplyDelete*I am aware there is an income inequality problem with bonds and the like (poor people cannot buy a $1,000 T-bill and preserve their wealth on the scale a wealthier person can).

If we hold our own debt, does it even exist?

DeleteYour example is the "people" lending to their country. Today, we've got our country lending to our country. Your example shifts the burden to the people. Mine seems to add to zero...no transfer of obligation. Your example is from bygone days when financial markets functioned properly. Oh, how I long for those days!

And yes, holding our own debt should lessen the burden - from a payment standpoint. But it exists in the markets and will cause the USD's value to be impacted, globally. But that's only if and when the USD stops being in shortage and stops being the reserve currency. We're taking advantage of that right now. Let's hope the music doesn't stop.