We seemed to finally get the selloff, driven by tech, that I've been predicting. Microsoft had a great quarter but nothing incrementally positive to keep the stock heading higher. Apple got downgraded and is being investigated for price gouging or abusing monopoly power. Tesla seems to have cracked - with investors figuring out that their core business, selling cars, isn't turning a profit. The VIX jumped too. Somehow, small caps finished in the green.

Intel had a solid quarter, but like MSFT, didn't have anything incremental to say to drive more upside...so the stock is looking weak.

___________________________________________

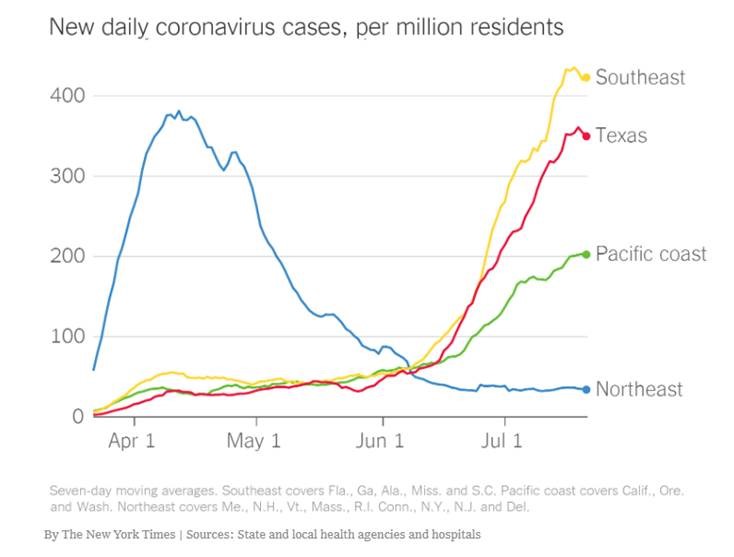

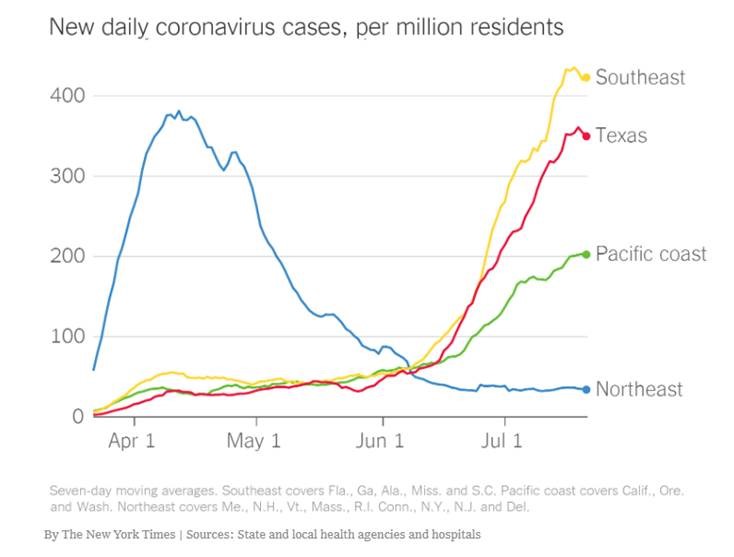

1) The rest of the country opened up right about when cases started to jump. And it's not driven by increased testing as testing positivity rates actually increased. Who needs masks?

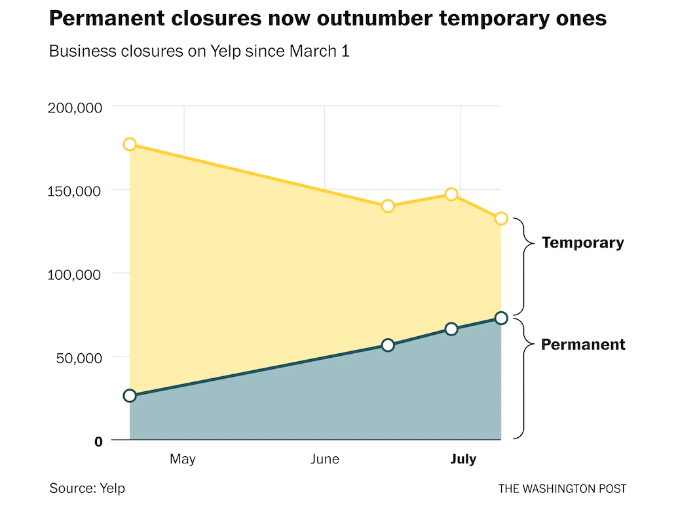

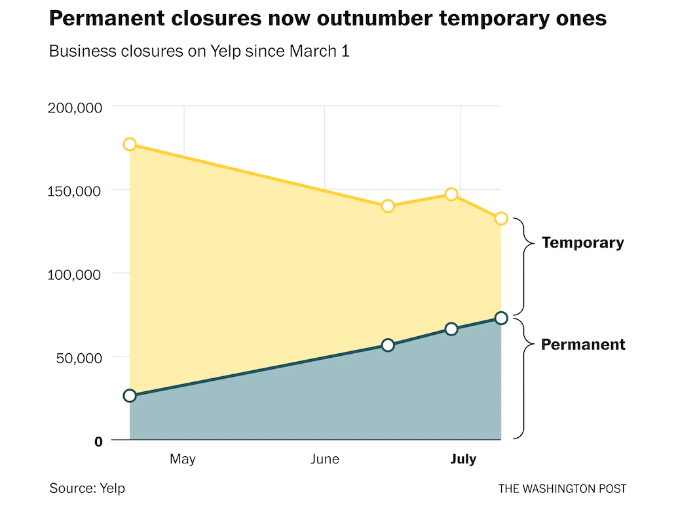

2) Permanent vs. Temporary closures. Looks like things are getting worse...who would have predicted that?

3) Speaking of Apple and being a monopoly, this is what happened when Microsoft was found to be doing the same thing. It popped the tech bubble and pulled down the broader, S&P 500 as well. Is this time different?

_____________________________________

An hour before yesterday's selloff, I wrote in my EIX trade note that "I've got a feeling weakness is coming." I hate using the "feeling" word, but sometimes we get "feelings". Knowing when to fade them or lean into them is an art. Yesterday, my "feelings" were correct.

I covered my Apple short at a slight gain. When you start out wrong/early on a trade and double down at the right time, you can turn a loss into a win. I honestly believe Apple shares will get to $350 or lower, but holding that position isn't worth at given the rest of my portfolio at this point.

As it is Friday, I'll be looking to reduce my weekend long exposure down to ~10% or so from ~19% this morning. That means buying a few ETFs, just like last week. Which ones they'll be is yet to be decided.

It turned out to be a pretty decent week, assuming today isn't a trainwreck. I hope yours was as well.

Intel had a solid quarter, but like MSFT, didn't have anything incremental to say to drive more upside...so the stock is looking weak.

___________________________________________

1) The rest of the country opened up right about when cases started to jump. And it's not driven by increased testing as testing positivity rates actually increased. Who needs masks?

2) Permanent vs. Temporary closures. Looks like things are getting worse...who would have predicted that?

3) Speaking of Apple and being a monopoly, this is what happened when Microsoft was found to be doing the same thing. It popped the tech bubble and pulled down the broader, S&P 500 as well. Is this time different?

_____________________________________

An hour before yesterday's selloff, I wrote in my EIX trade note that "I've got a feeling weakness is coming." I hate using the "feeling" word, but sometimes we get "feelings". Knowing when to fade them or lean into them is an art. Yesterday, my "feelings" were correct.

I covered my Apple short at a slight gain. When you start out wrong/early on a trade and double down at the right time, you can turn a loss into a win. I honestly believe Apple shares will get to $350 or lower, but holding that position isn't worth at given the rest of my portfolio at this point.

As it is Friday, I'll be looking to reduce my weekend long exposure down to ~10% or so from ~19% this morning. That means buying a few ETFs, just like last week. Which ones they'll be is yet to be decided.

It turned out to be a pretty decent week, assuming today isn't a trainwreck. I hope yours was as well.

Comments

Post a Comment