I slept pretty well last night and woke up earlier than normal. I've been drinking coffee and letting my mind wander around various topics. It's been a great morning.

I become a bit of a political junkie in Presidential cycles. Normally, it's just for fun. I watch both conventions to see and hear the stark differences in how our nation should be run. I've never been a swing voter by any means, but still think it's my duty to know the broad goals of each party. It's pretty clear that one party is trying to connect with the majority of Americans while the other is doubling down on their extreme base.

President Obama gave a powerful speech yesterday night. If you expected anything less, you've never heard him speak. I never "liked" or "agreed" with most of his speeches, but have always recognized his oratory skill. His killer line last night was about hoping the weight of the office of President would force Trump to take it seriously, represent ALL Americans, and grow into the job...but that Trump has shown that he's "incapable of growing into the job". I think that sums up this election cycle and Donald Trump's Presidency pretty well.

Futures are red, so expect headlines about vaccine hopes or stimulus talks. (As it happens, I saw a China Trade Deal headline as I was typing...lol)

NVDA, one of my favorite shorts at 60x+ P/E, reported great numbers last night but is trading down this morning. Obviously, it needed better than great numbers for the stock to keep going up. The big tech silly valuations need bigger and bigger beats to keep going vertical. That's just math. Or more fools to keep buying.

It's Thursday, so we'll get Initial Jobless Claims an hour before the open. Last week was the first below 1 million since the lockdowns began, so use that as a reference point this morning.

________________________________________________________-

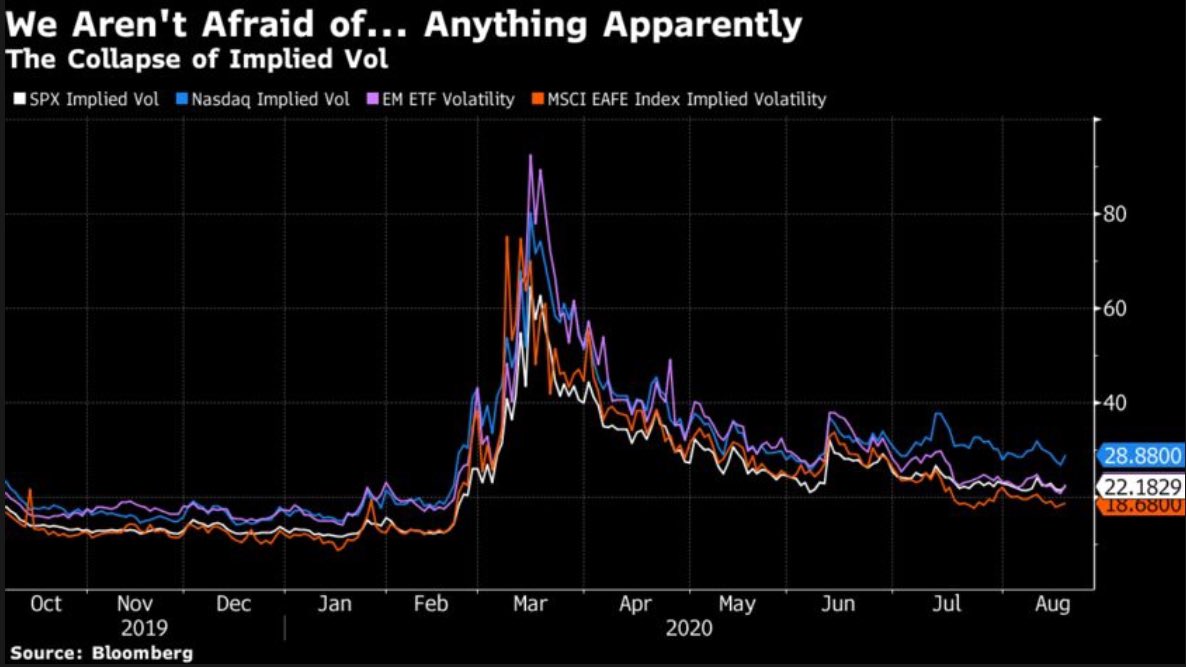

1) Volatility is way, way down. People aren't worried about the markets. That's worrisome to me.

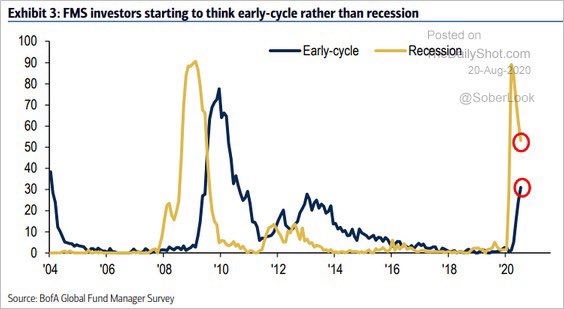

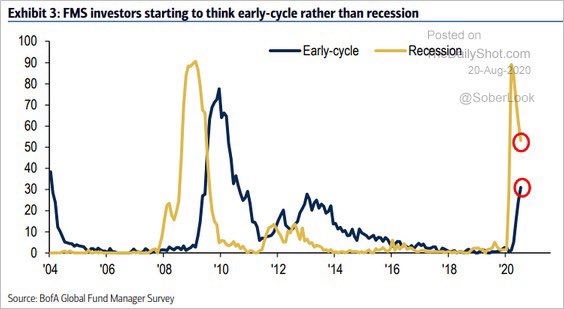

2) Fund managers think we're past the recession. Maybe they don't follow the data and use their "gut" and "feelings" to make "picks".

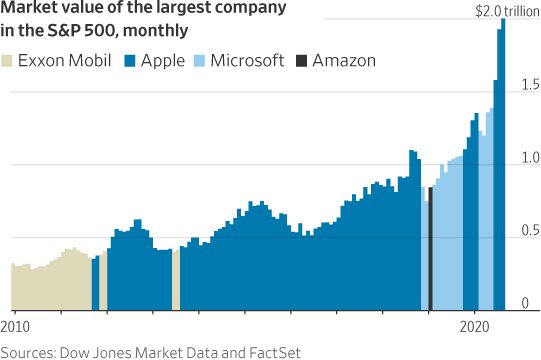

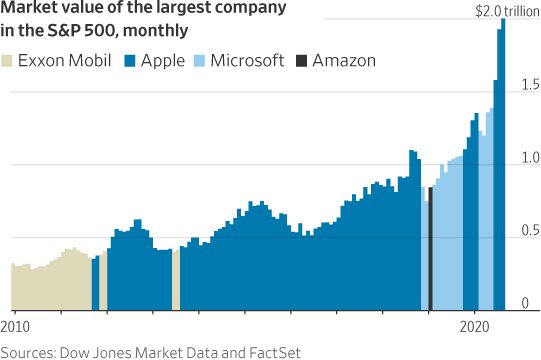

3) No bubble here...

_____________________________________________________

I'd love to reduce my gross exposure from 85% down to 60% or so. I need a pullback in Japan and for my long positions to work. You know, just a bit of alpha.

Watch the VIX today. It jumped late in the day yesterday and looks to be up again this morning. If it stays here, we're due for a 1.0-1.5% selloff but S&P futures are only down 0.25%. Sellers might show up at the open - depending on the jobs data.

A bit disjointed of a Daily Note, but hopefully it helps. Lots of stuff to think about.

Comments

Post a Comment