Sometimes the lunacy of the markets amazes me. We've been able to track covid cases, basically in real-time, but the market ignored it. Until we - both the USA and the world - set new records for cases in a single day on back-to-back-to-back days and new lockdowns are being put into place around the country and world. Also, the stimulus hopes seem to be quashed for the time being.

I don't think we've yet seen the pain of the damage caused by the recession (that started before the virus hit) and the subsequent lockdowns and jobless spike. We haven't seen businesses fail. There's not a rush of bankruptcies. No homes being foreclosed. No stories about cars being reposessed. Nothing. No pain.

But it's there. And until we see the pain - or a stimulus more than $1,200 to end the pain - it's not over.

Futures are red today, if that's not clear.

__________________________

1) CDS (credit default swaps) holders are getting paid next to nothing when a loan/swap goes bad! Look at the rate in 2009 for context. This is bad.

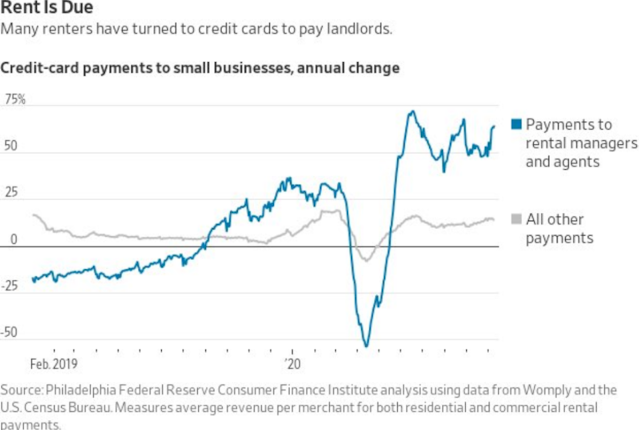

2) Renters are making their payments using credit cards...and letting balances accrue.

3) It's almost as if masks work...

__________________________

So long as the selloff doesn't take too big of a hold, I'll be looking to sell some puts. Specifically, EBAY - who reports tonight. But also TWTR, BUD, KHC who report tomorrow morning. Option premiums should be generous with the VIX spiking to the high 30s.

Comments

Post a Comment